Why Business Interruption Insurance Is Essential

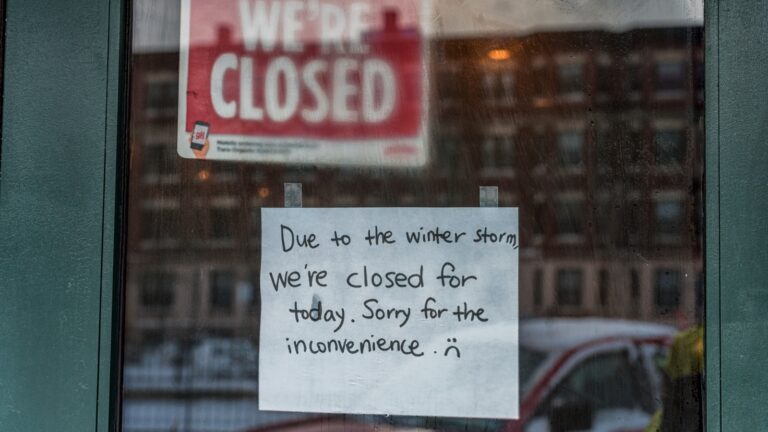

For any company, the need to generate revenue doesn’t stop just because you encounter operational challenges. Business Interruption (BI) insurance is designed to cover the income gap when unforeseen events, such as fires or storms, disrupt your operations. This insurance can be your safety net when damages render your business premises unsafe or when critical equipment breaks down. While property insurance takes care of rebuilding structures and replacing equipment, BI insurance focuses on compensating for lost income during these downtimes.

Preserve Cash Flow with Ongoing Expense Coverage

BI insurance doesn’t just replace lost income; it also covers essential ongoing expenses that you can’t simply pause. This could include covering payroll, rent, utilities, and loan payments. Some policies have limitations for non-essential staff, but many offer flexibility to support longer outages, which helps protect relationships with vendors and maintain your credit status.

Speed Up Recovery with Extra Expense Coverage

Minimizing downtime is crucial, and extra expense coverage allows you to incur reasonable costs to expedite recovery. This might involve leasing temporary locations, hiring additional contractors, or using substitute equipment. By investing upfront to reduce the overall impact, businesses can often come out ahead. It’s wise to document these expenses meticulously, keeping track of invoices, quotes, and other pertinent details to make sure that you have clear communication with your insurer.

Navigating Challenges Beyond Your Control

Interruptions aren’t always contained to your premises. If government actions block access due to nearby hazards, civil authority coverage might assist. Although it often includes a waiting period, this coverage can be a lifeline. Similarly, contingent business interruption insurance addresses losses from disruptions affecting primary suppliers or key clients. Prepare to substantiate these claims with appropriate documentation, like purchase orders and correspondence.

Building Your Business Interruption Insurance

The key to effective BI insurance is fitting it to your business’s unique needs. Consider your financial structure and the specific risks you face. Calculating limits should factor in gross earnings, seasonality, and potential growth to avoid underinsurance. Waiting periods and deductibles should align with your cash flow capabilities, and indemnity periods might need to extend up to two years, especially for complex recoveries. Regularly reviewing policy details, such as coinsurance clauses, can help make sure your coverage remains effective.

Interested in safeguarding your business against unexpected interruptions? Contact The Southern Agency today at thesouthernagency.com for solutions that protect your bottom line. Our experienced agents are ready to assist you with comprehensive advice on modeling the right insurance strategies for your needs.

Prepare your business for the unexpected. Get in touch with The Southern Agency to discuss how our insurance solutions can support your long-term success. Call us now at 800-777-1872 or visit thesouthernagency.com to learn more about our services.