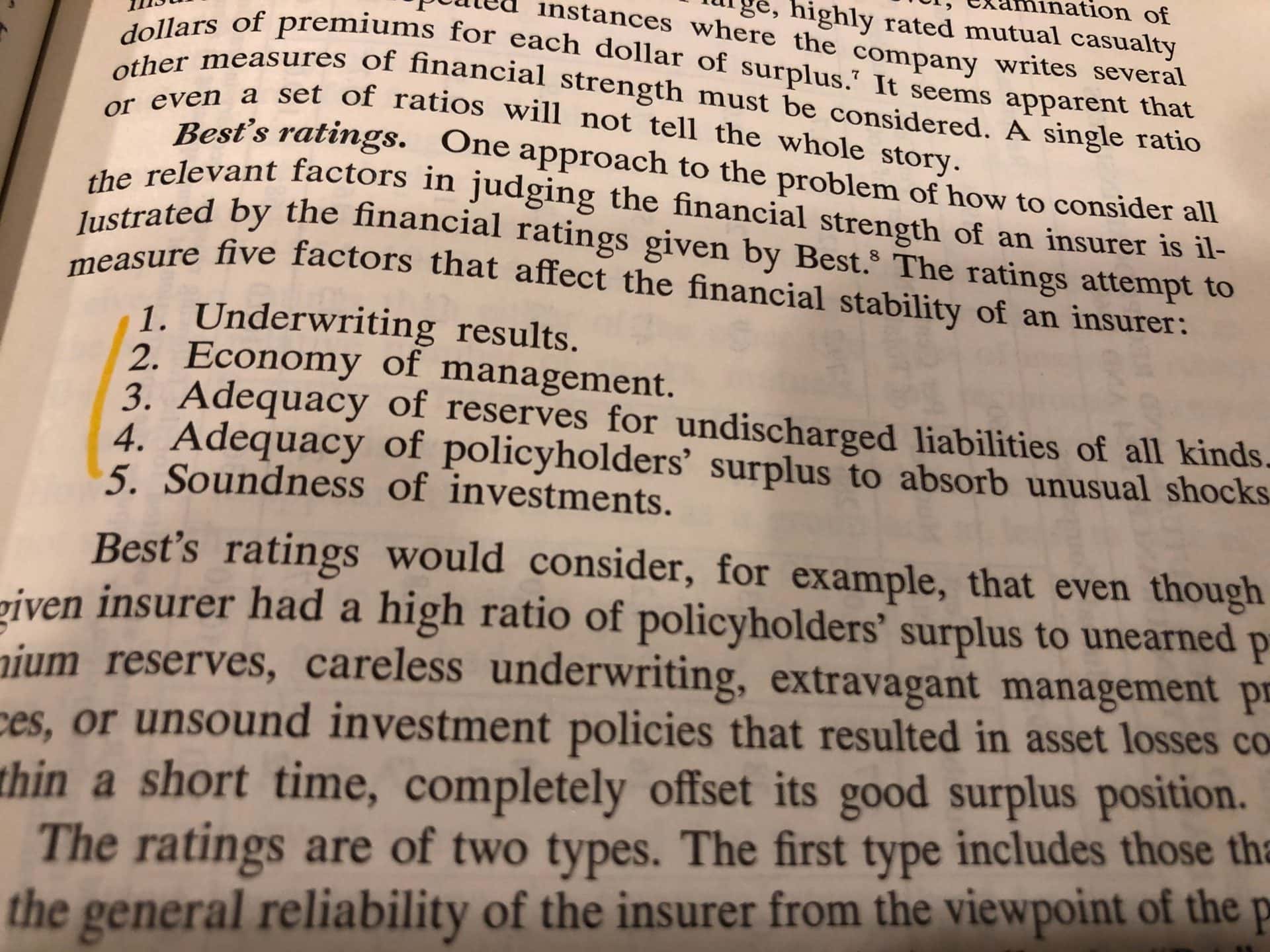

A policyholder should desire only to be insured with an insurance company that is financially responsible and strong. Insurance companies are rated based on their financial strength, reputation in claim handling, competence of management, and the caliber of their agency force. The most common rating agency is A. M. Best®. Best’s rating system currently ranges from A++ (A++ is the very Best) to E (insurance companies under regulatory or Department of Insurance supervision). Other rating agencies include Standard & Poor’s®, Moody®, Fitch Ratings®, etc.

Some insurance carriers have elected not to be rated due to the cost, the length of time they have been in business, or they have had financial setbacks in the immediate past. For these reasons and others, insurance companies have strategically decided to not be rated. A bad rating could possibly have a negative impact on the insurance company.

Whistle-stop: Concern yourself with the financial rating of your insurance company. Consult with your insurance agent for details on the insurance carrier’s A. M. Best rating.

Operations of an Insurance Company

Underwriting profits are the goal…

Insurance companies need to make profit in order to be strong in the toughest of times. The last thing a policyholder wants is for his insurance agent to place his or her insurance policies with a carrier that is having (or will have) trouble paying claims. An insurance company’s first goal is to have enough premium dollars to cover its losses (without dipping into reserves). An insurance company arrives at an underwriting profit by charging more for its policies than the cost of the claims and their expenses.

Underwriter’s talent…

Underwriting is not just a part of insurance—it is the lifeblood of insurance. An underwriter is the person in the Underwriting Department who approves risk for the agent. Underwriters possess a body of knowledge acquired through much study and many years of experience. Underwriters analyze the probability of risks and consider ways to react to these risks. No two businesses are identical. The task of the underwriter is to select those who will be profitable to their insurance company. This is no small task; in fact, it is sort of like predicting the future—and none of us are a Nostradamus!

The balancing act…

Some thirty-five to forty cents of every dollar of premium that an insurance company receives goes to pay the overhead while the balance is to pay the claims; and hopefully, if any is left over, to retain and invest, pay dividends to their stockholders, or give back to their policyholder. The insurance premium charges on policies cycles up and down as a result of the profits or losses from both the policies earnings and their investment income.

How an insurance company knows how much to charge is the trick…

The insurance companies hire statisticians called actuaries. These highly skilled folks take many pieces of information to develop premium thresholds that must be maintained to earn a profit. They predict accurately expected losses in the future based on historical information, trends, and forecasts. This expertise is beyond me, but the results of an insurance company are highly dependent on the Actuary Department. With the aid of computers, these departments rely heavily on predictive analytics software. I have even seen how one side of town’s rates are much more aggressive because of prior year’s storm activity.

I will pick up where I left off on the next blog post, so stay tuned!

If you’d like to review your business or personal insurance, please call us at 423-763-1111. We hope to answer your questions and serve you!