Don’t Select Insurance Based on Price Alone

If a business owner intends on looking at other options on his insurance, they should speak to their agent and discuss their intentions to “shop” the insurance package with alternative agents. Moving insurance to “save a buck” may not be in his best interest but moving for better insurance coverage is. Economic progress to gain profit and net worth is the yardstick many business owners use to measure success, but do not skimp on the insurance coverages to get there.

A word of caution to those purchasing insurance: Do not necessarily take the “low bid.” Find a Professional Agent who understands your exposures and is willing to be your personal agent, your confidant, and your insurance helper. Yes, there may be a day where this person will let you down, and there will be a time when you might have to have the hard conversation with him; however, this person should be viewed like your other professionals: your accountant, your banker, or your lawyer. If you have received this link from your accountant, your banker, or your lawyer, they too are interested in your welfare.

The Mark of a Quality Insurance Agent

Deal only with an agent who stops to listen to your concerns, who asks many questions about your operations, and explains what insurance coverage he believes you should secure. The agent should have a careful eye to your exposures. Your “peace-of-mind” will never come until you have found this agent. Believe me, he or she is out there. You need to buy from your most trusted source. Sometimes, you may have to go outside your area to find this trusted insurance advisor. Don’t give up.

When you connect with the right agent, also allow the agency to review your personal insurance too. Please keep us in mind for this very important insurance, too! In the Chattanooga, Atlanta, and Nashville areas, we now offer Auto Insurance and Home Insurance! Often times, there are advantages to placing all your coverages with the same agency. Your agent should be aware of all of your exposures. Give special attention to reviewing your personal auto coverages with him. Soon, I will address big concerns a business owner should have about their business auto insurance for properly titling/registering autos, trucks, and trailers in the business.

Some insurance agents from time to time gain a bad reputation. For example, several years ago, a local agent in Chattanooga tarnished his reputation from allegations of fraudulent insurance billings to clients. Whether the charges are true are not, that insurance agent will never be viewed the same in our industry. It is my hope that you find an agent who values his reputation more than what is in the vault. “A good name is more to be desired than great riches…” Proverbs 22:1.

Retailers sell products, manufacturers make widgets, homebuilders build homes, contractors fix up buildings, but insurance agents sell a promise for the insurance company to respond to accidents and other claims. Insurance is an intangible product that is merely a promise to pay in the event of a covered claim. Choose well your agent and insurance company that makes the promise!

Ten questions to ask your agent

-

What is your experience in insuring businesses like mine?

-

How often will you review my coverage with other insurance companies?

-

Who in your agency will be servicing my policies?

-

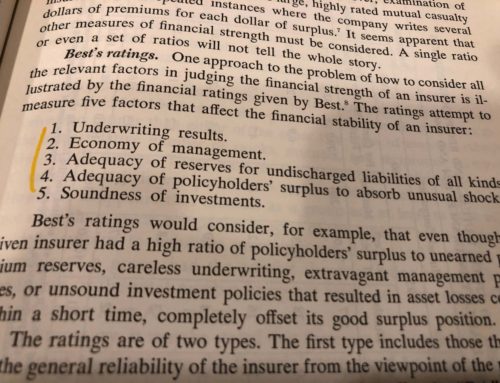

What is the insurance company’s financial rating that you propose?

-

What else can I do to save money?

-

How can you help me simplify my audit and be prepared for it?

-

What help will you or the insurance company provide in safety measures to avoid losses?

-

Should I elect Workers Compensation coverage on myself? If not, can I get some protection in the event I become disabled?

-

Other than my own insurance, what can I do to minimize my risks?

-

How do I determine and properly budget my premium?

If you’d like to review your business or personal insurance, please call us at 423-763-1111. We hope to answer your questions and serve you!