Importance of the Government to the Insurance Industry

Travel through virtually any county or parish in America and observe that one of the most prominent structures is the courthouse. Note the many law offices nearby. In state capitols, the legislative buildings are normally the most prominent.

Courts, legislatures, state departments of insurance, and the legal profession have helped shape the field of insurance from the outset. Fire and police officials have helped protect what is insured. The municipal water works supplies the water that puts out the fires. Law enforcement catches the criminals who steal or destroy construction materials. County and city codes and permit officials inspect for safety. All of these entities benefit the insurance companies and policyholders. Government services are essential to a healthy insurance industry.

Insurance and Construction Industries

The construction industry and insurance share a common bond. They are two of the most highly regulated industries in America. For the most part, states across the country regulate both the construction and insurance industry. State legislatures have the ultimate power to make and amend laws involving both industries. Laws governing both industries promote a high standard for public and occupational protection.

- For construction: Building codes, licensing, Workers Compensation benefit and investigating complaints.

- For insurance: Approving insurance policy forms and rates, licensing and investigating notices of unethical business practice.

- Both insurance companies and states are keenly involved in safety to workers. Government implements and enforces OSHA regulations. Insurance Companies provide the finest safety specialists available.

- Contractors Licensing Board regulators require financial statements from contractors in establishing their license limit and approve the type work they may perform. These requirements help the contractor avoid being financially over-extended which could put the public at risk for a financial loss.

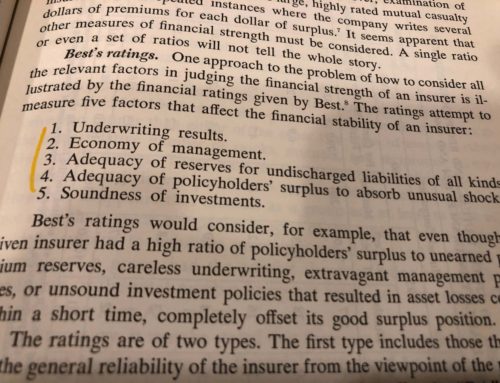

- Departments of Insurance require insurance companies to provide financial statements annually to prove that they can meet their financial obligations to their policyholders.

These and many other state regulations help assure both the construction and insurance industries are competent in their operations and ethical in their business dealings.

If you’d like to review your business or personal insurance, please call us at 423-763-1111. We hope to answer your questions and serve you!