The Ratings and Operations of Insurance Companies – Part One

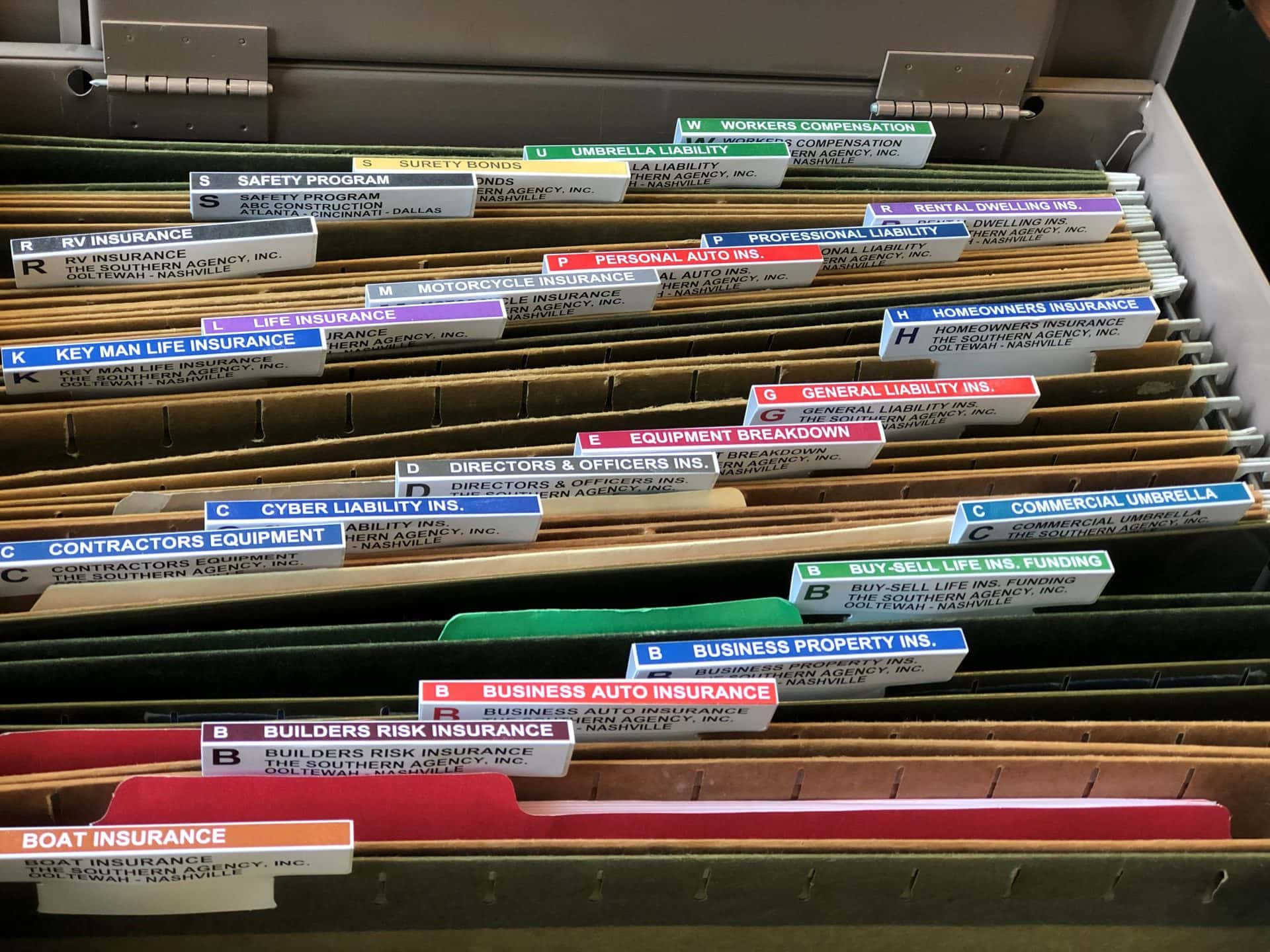

A policyholder should desire only to be insured with an [...]

The Standardization of Policies

Years ago, progress was made to standardize insurance policy language. [...]

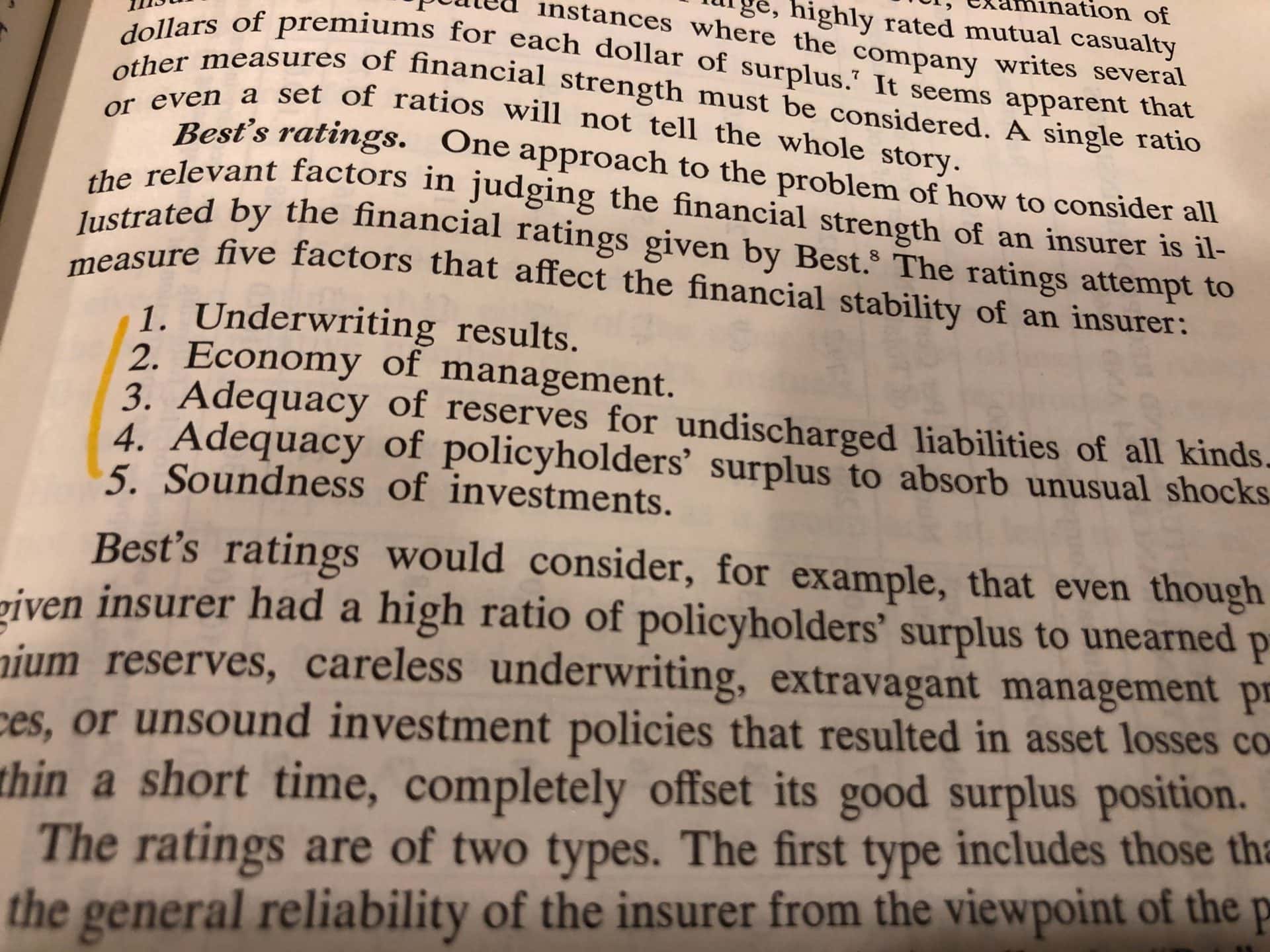

Standards of Insurance

A college textbook on insurance published in 1954 contains the [...]

Insurance Premium Swings

External Factors Affect Premiums There are so many factors that [...]

Spend Time With Your Agent Understanding Your Policies

Each of our blogs are going to be covering specific [...]

The User’s Guide to Good Insurance

My dad told me when he was training me “that [...]